Triton, a Mumbai-based venture capital firm, has announced the first close of its second fund, raising ₹120 crore ($28 million) out of its targeted ₹240 crore. The fund is over five times larger than Triton’s first fund and will continue its focus on early-stage business-to-business (B2B) technology and tech-enabled services.

Triton’s first fund backed enterprise SaaS, artificial intelligence, B2B marketplaces, and marketing services startups. With the first fund nearing completion and showing strong returns, the firm aims to build on its momentum with the second fund, solidifying its position as a key investor in India’s B2B tech ecosystem.

Focus on Innovation and Strategic Investments

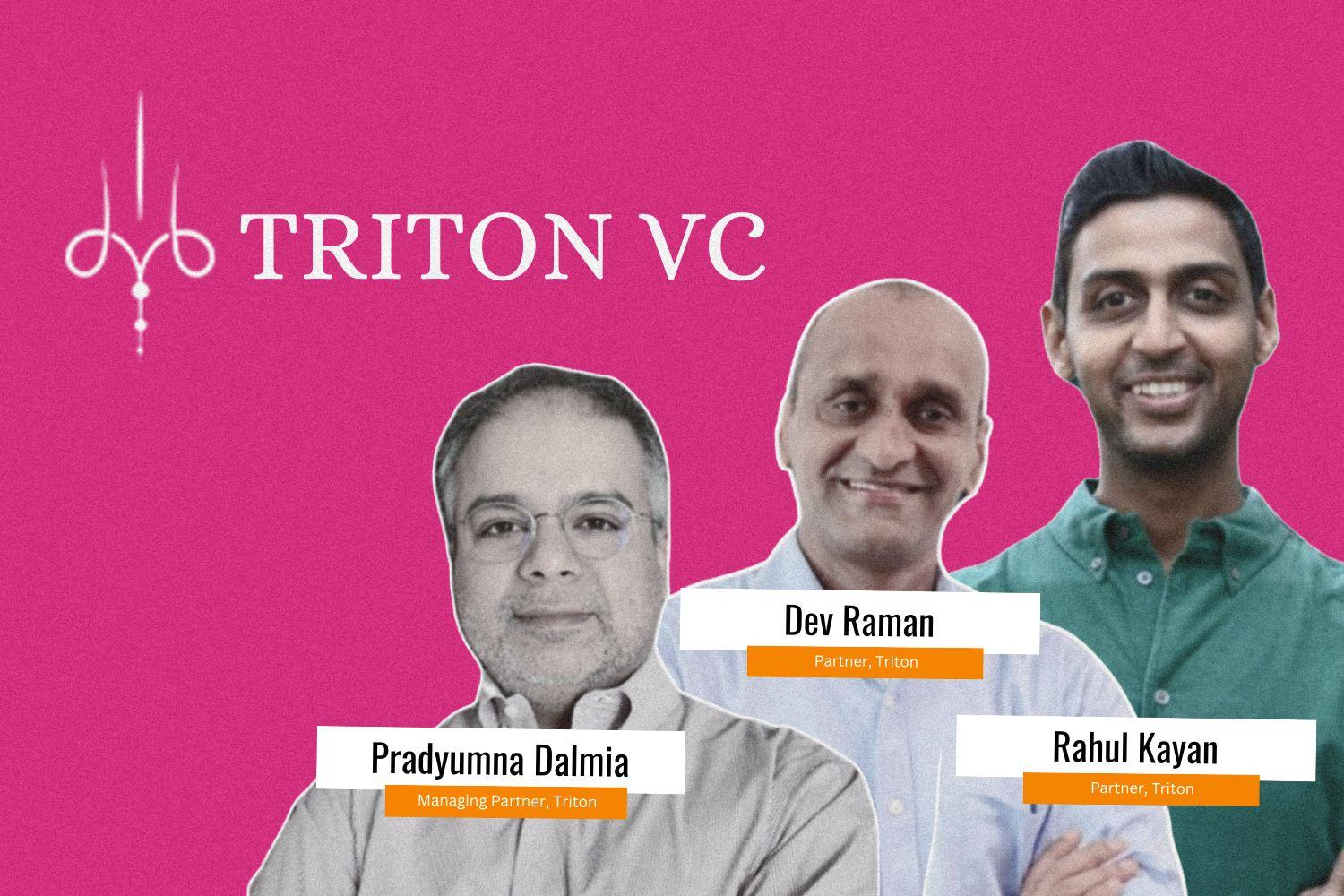

“Triton Fund II reflects our dedication to driving innovation in B2B Tech and supporting the next generation of transformative companies in India,” said Pradyumna Dalmia, Managing Partner at Triton. “With the strong performance of Fund I, we are well-positioned to create significant value for both our investors and portfolio companies.”

Triton’s first fund was smaller and focused on proving the firm’s investment thesis. It backed notable companies such as:

- Recykal (circular economy platform)

- ZingHR (HRTech)

- CamCom (AI-powered inspection tech)

- Bizom (retail intelligence)

Several companies from Triton Fund I have successfully raised follow-on funding. Recykal secured $22 million from Morgan Stanley India in 2022 and an additional $13 million from 360 ONE Asset Management in 2024. ZingHR raised $10 million from Tata Capital Growth Fund in 2020, while CamCom secured funding from 3Lines Venture Capital in 2021. Bizom’s parent company, Mobisy Technologies, raised $3.5 million in a Series A round led by SIDBI Venture Capital in 2021.

A Changing Funding Landscape

“With the funding euphoria behind us, we are now seeing high-quality founders adopting a more prudent approach to capital,” said Dev Raman, Partner at Triton. “We believe this will lead to a new wave of companies with strong economic foundations. At Triton, we aim to provide patient capital and strategic support to help these businesses scale and succeed.”

Triton Fund II will primarily invest in pre-Series A and Series A rounds, with initial investments ranging from ₹8–16 crores per company. The firm will continue to focus on enterprise SaaS, agentic AI, and deeptech—sectors that are rapidly evolving and attracting significant investor interest.

Our Opinion on the News

Triton’s successful first close of its second fund underscores the firm’s strong track record and the growing investor confidence in India’s B2B tech and tech-enabled services sectors. The substantial increase in fund size highlights Triton’s ambition to play a more significant role in supporting early-stage startups.

By targeting sectors like enterprise SaaS, AI, and deeptech, Triton is well-positioned to capitalize on emerging trends and help shape the next generation of transformative companies in India.