ArthAlpha, a cutting-edge investment technology platform, has raised $2 million in seed funding, with DSP leading the round. The investment also saw participation from family offices and wealth managers, reflecting growing investor confidence in AI-driven investment strategies.

About ArthAlpha

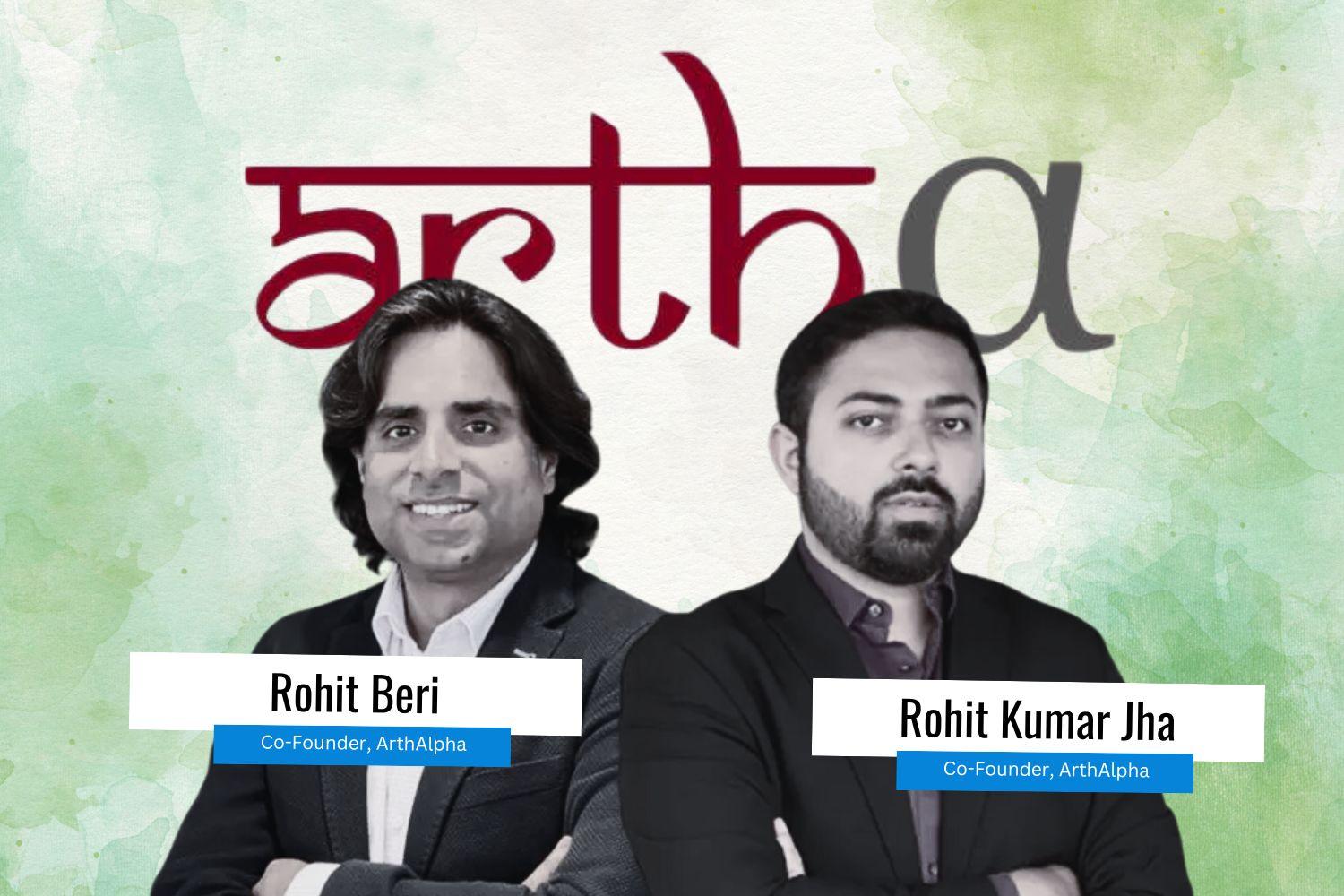

Founded in 2022 by Rohit Beri and Rohit Jha, ArthAlpha is an AI-powered investment management firm specializing in Portfolio Management Services (PMS) and data-driven research. The company’s mission is to deliver superior long-term returns by leveraging artificial intelligence and deep market insights.

Utilization of Funds

The newly acquired capital will be directed towards:

- Expanding research and development teams

- Enhancing proprietary investment algorithms

- Scaling a quantitative investment research platform

- Strengthening data analytics and AI capabilities

This funding aligns with ArthAlpha’s broader vision of transforming investment management through AI-driven decision-making tools.

Leadership & Investor Insights

Rohit Beri, CEO and CIO of ArthAlpha, emphasized the significance of this funding round, stating:

"This investment validates our vision to redefine investment management through AI and data-driven insights. We aim to empower investors with smarter, more personalized strategies."

Aditi Kothari, Vice Chairperson of DSP Mutual Fund, added:

"We believe in the transformative power of technology in investments. ArthAlpha’s approach represents the future of investment management, combining AI-driven analytics with deep market expertise."

Our Opinion on the News

ArthAlpha’s successful funding round reflects the growing institutional trust in AI-based investment research. With increasing digitization in financial markets, the company is well-positioned to disrupt traditional investment management by delivering data-driven and scalable solutions. If executed effectively, ArthAlpha could emerge as a key player in the Indian wealth management and asset advisory space.